Journal of Social Systems and Policy Analysis

ISSN: 3068-5540 (Online)

Email: [email protected]

Submit Manuscript

Edit a Special Issue

Submit Manuscript

Edit a Special Issue

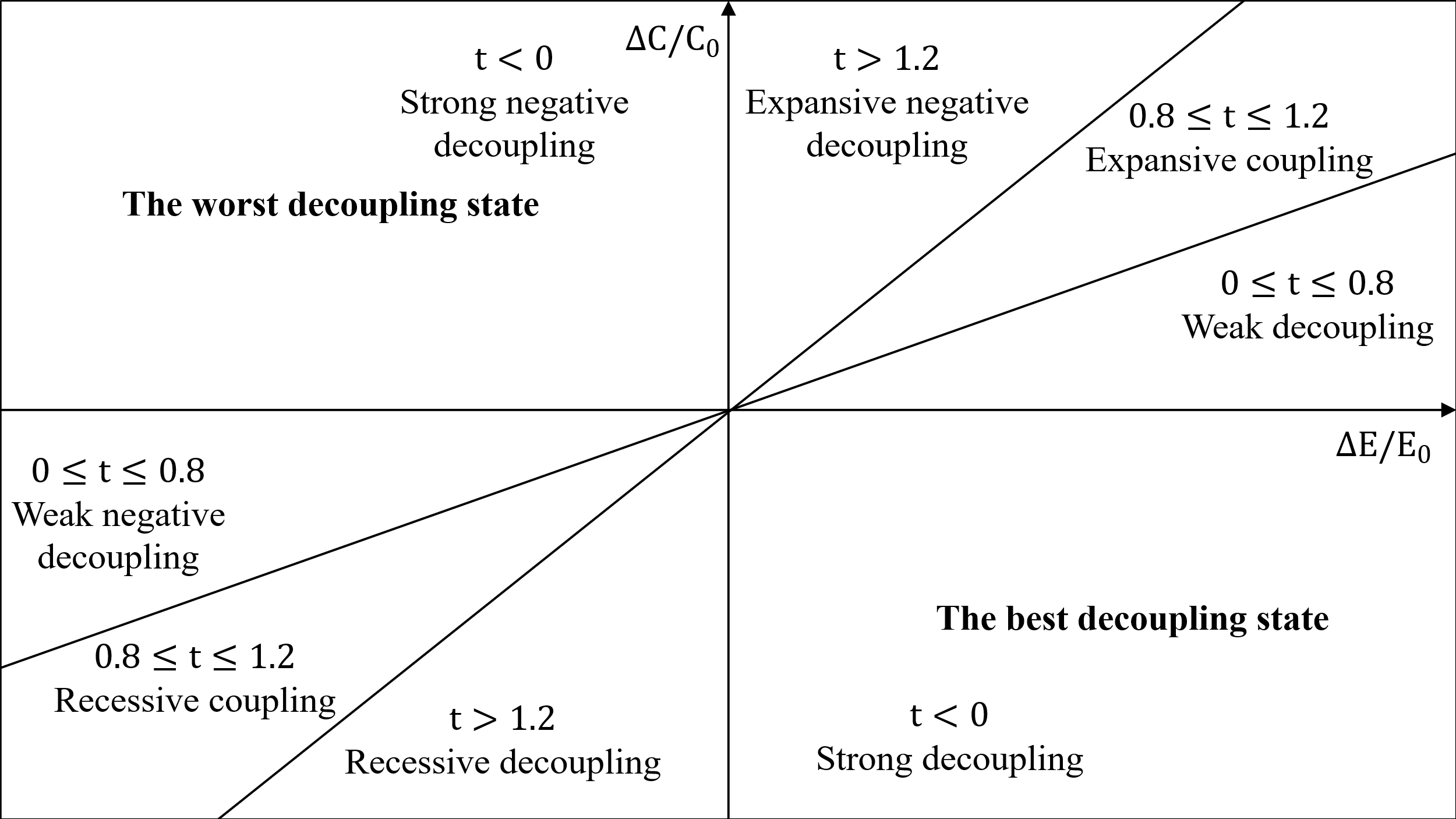

TY - JOUR AU - Chen, Fang PY - 2026 DA - 2026/01/30 TI - The Nonlinear Impact of FDI on Economic Growth and Carbon Emissions: Evidence from RCEP Countries JO - Journal of Social Systems and Policy Analysis T2 - Journal of Social Systems and Policy Analysis JF - Journal of Social Systems and Policy Analysis VL - 3 IS - 1 SP - 1 EP - 14 DO - 10.62762/JSSPA.2025.514568 UR - https://www.icck.org/article/abs/JSSPA.2025.514568 KW - FDI KW - economic growth KW - carbon emissions KW - nonlinearity KW - RCEP AB - To investigate the decoupling effect of Foreign Direct Investment (FDI) on carbon emissions, this study employs nonlinear panel models and threshold regression models to analyze the impact of FDI on economic growth and carbon emissions in RCEP member countries from 2000 to 2023. First, the Tapio decoupling model reveals that since 2012, the relationship between economic growth and carbon emissions has predominantly exhibited a weak decoupling state. Second, the results from the nonlinear panel models and threshold models indicate that FDI has a significant "U-shaped" nonlinear relationship with both economic growth and carbon emissions. Specifically, in terms of economic effects, FDI may initially suppress economic growth, but ultimately contribute to it. In terms of environmental effects, FDI initially shows emission reduction benefits, but may eventually intensify carbon emissions. The moderating effect model shows that digital infrastructure significantly weakens these "U-shaped" relationships, reducing the steepness of the original curves. Finally, based on this "U-shaped" relationship and the moderating role of digital infrastructure, policy suggestions are put forward to enhance the synergistic benefits of FDI for both economic development and environmental sustainability. The findings of this study shed new light on the classic debate concerning foreign direct investment (FDI), economic development, and environmental sustainability within the RCEP context. SN - 3068-5540 PB - Institute of Central Computation and Knowledge LA - English ER -

@article{Chen2026The,

author = {Fang Chen},

title = {The Nonlinear Impact of FDI on Economic Growth and Carbon Emissions: Evidence from RCEP Countries},

journal = {Journal of Social Systems and Policy Analysis},

year = {2026},

volume = {3},

number = {1},

pages = {1-14},

doi = {10.62762/JSSPA.2025.514568},

url = {https://www.icck.org/article/abs/JSSPA.2025.514568},

abstract = {To investigate the decoupling effect of Foreign Direct Investment (FDI) on carbon emissions, this study employs nonlinear panel models and threshold regression models to analyze the impact of FDI on economic growth and carbon emissions in RCEP member countries from 2000 to 2023. First, the Tapio decoupling model reveals that since 2012, the relationship between economic growth and carbon emissions has predominantly exhibited a weak decoupling state. Second, the results from the nonlinear panel models and threshold models indicate that FDI has a significant "U-shaped" nonlinear relationship with both economic growth and carbon emissions. Specifically, in terms of economic effects, FDI may initially suppress economic growth, but ultimately contribute to it. In terms of environmental effects, FDI initially shows emission reduction benefits, but may eventually intensify carbon emissions. The moderating effect model shows that digital infrastructure significantly weakens these "U-shaped" relationships, reducing the steepness of the original curves. Finally, based on this "U-shaped" relationship and the moderating role of digital infrastructure, policy suggestions are put forward to enhance the synergistic benefits of FDI for both economic development and environmental sustainability. The findings of this study shed new light on the classic debate concerning foreign direct investment (FDI), economic development, and environmental sustainability within the RCEP context.},

keywords = {FDI, economic growth, carbon emissions, nonlinearity, RCEP},

issn = {3068-5540},

publisher = {Institute of Central Computation and Knowledge}

}

Copyright © 2026 by the Author(s). Published by Institute of Central Computation and Knowledge. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made.

Copyright © 2026 by the Author(s). Published by Institute of Central Computation and Knowledge. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made.

Portico

All published articles are preserved here permanently:

https://www.portico.org/publishers/icck/