Journal of Social Systems and Policy Analysis

ISSN: 3068-5540 (Online)

Email: [email protected]

Submit Manuscript

Edit a Special Issue

Submit Manuscript

Edit a Special Issue

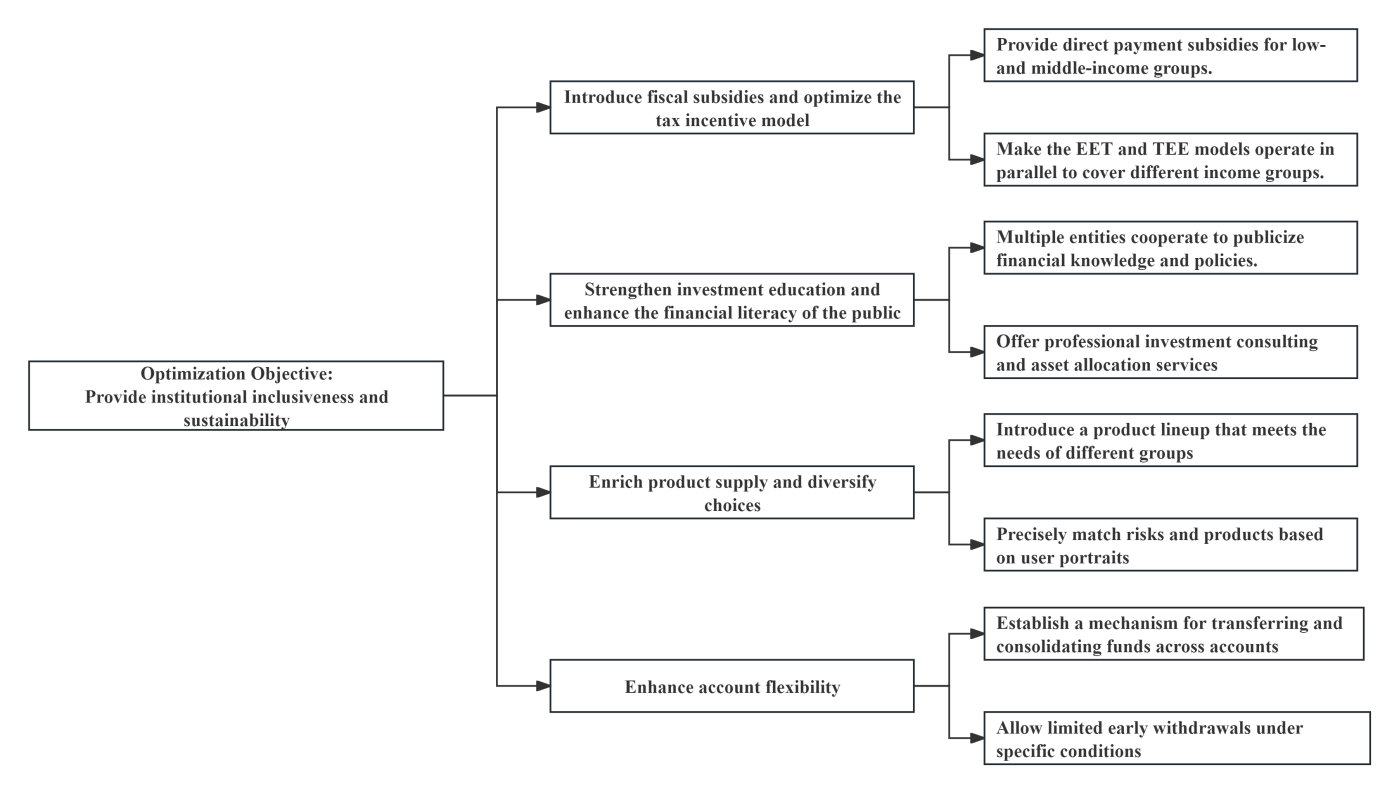

TY - JOUR AU - Yao, Shi PY - 2025 DA - 2025/12/19 TI - Optimizing China’s Private Pension Scheme via Experiences of Developed Countries JO - Journal of Social Systems and Policy Analysis T2 - Journal of Social Systems and Policy Analysis JF - Journal of Social Systems and Policy Analysis VL - 2 IS - 4 SP - 203 EP - 214 DO - 10.62762/JSSPA.2025.825683 UR - https://www.icck.org/article/abs/JSSPA.2025.825683 KW - private pension KW - policy reform KW - third pillar KW - developed country KW - optimization path AB - At present, the aging process of China’s population is accelerating very rapidly. As the third pillar of the pension security system, the private pension scheme has faced challenges such as low participation rates since its pilot launch in November 2022. Through analyzing its development history and current situation, this study has identified problems in China’s private pension scheme, including insufficient coverage of the population, weak tax incentives, lack of investment consulting services, and poor account flexibility. Meanwhile, this study has reviewed the experiences of developed countries such as the flexible transfer of IRA accounts in the United States, differentiated subsidies for the Lister pension in Germany, exclusive pension plans for different groups in Japan, and the possibility of early withdrawal of account funds for specific purposes in New Zealand and Canada. Based on these, the study proposes an optimization path for China’s private pension scheme that is in line with national conditions, from introducing fiscal subsidies and optimizing tax incentive models, strengthening investment education, enriching product supply, and enhancing account flexibility. Ultimately, this study provides theoretical and practical references for its sustainable development, aiming to improve the scheme’s inclusiveness and sustainability and offer more reliable pension security for residents in China. SN - 3068-5540 PB - Institute of Central Computation and Knowledge LA - English ER -

@article{Yao2025Optimizing,

author = {Shi Yao},

title = {Optimizing China’s Private Pension Scheme via Experiences of Developed Countries},

journal = {Journal of Social Systems and Policy Analysis},

year = {2025},

volume = {2},

number = {4},

pages = {203-214},

doi = {10.62762/JSSPA.2025.825683},

url = {https://www.icck.org/article/abs/JSSPA.2025.825683},

abstract = {At present, the aging process of China’s population is accelerating very rapidly. As the third pillar of the pension security system, the private pension scheme has faced challenges such as low participation rates since its pilot launch in November 2022. Through analyzing its development history and current situation, this study has identified problems in China’s private pension scheme, including insufficient coverage of the population, weak tax incentives, lack of investment consulting services, and poor account flexibility. Meanwhile, this study has reviewed the experiences of developed countries such as the flexible transfer of IRA accounts in the United States, differentiated subsidies for the Lister pension in Germany, exclusive pension plans for different groups in Japan, and the possibility of early withdrawal of account funds for specific purposes in New Zealand and Canada. Based on these, the study proposes an optimization path for China’s private pension scheme that is in line with national conditions, from introducing fiscal subsidies and optimizing tax incentive models, strengthening investment education, enriching product supply, and enhancing account flexibility. Ultimately, this study provides theoretical and practical references for its sustainable development, aiming to improve the scheme’s inclusiveness and sustainability and offer more reliable pension security for residents in China.},

keywords = {private pension, policy reform, third pillar, developed country, optimization path},

issn = {3068-5540},

publisher = {Institute of Central Computation and Knowledge}

}

Copyright © 2025 by the Author(s). Published by Institute of Central Computation and Knowledge. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made.

Copyright © 2025 by the Author(s). Published by Institute of Central Computation and Knowledge. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made.

Portico

All published articles are preserved here permanently:

https://www.portico.org/publishers/icck/