ICCK Transactions on Emerging Topics in Artificial Intelligence

ISSN: 3068-6652 (Online)

Email: [email protected]

Submit Manuscript

Edit a Special Issue

Submit Manuscript

Edit a Special Issue

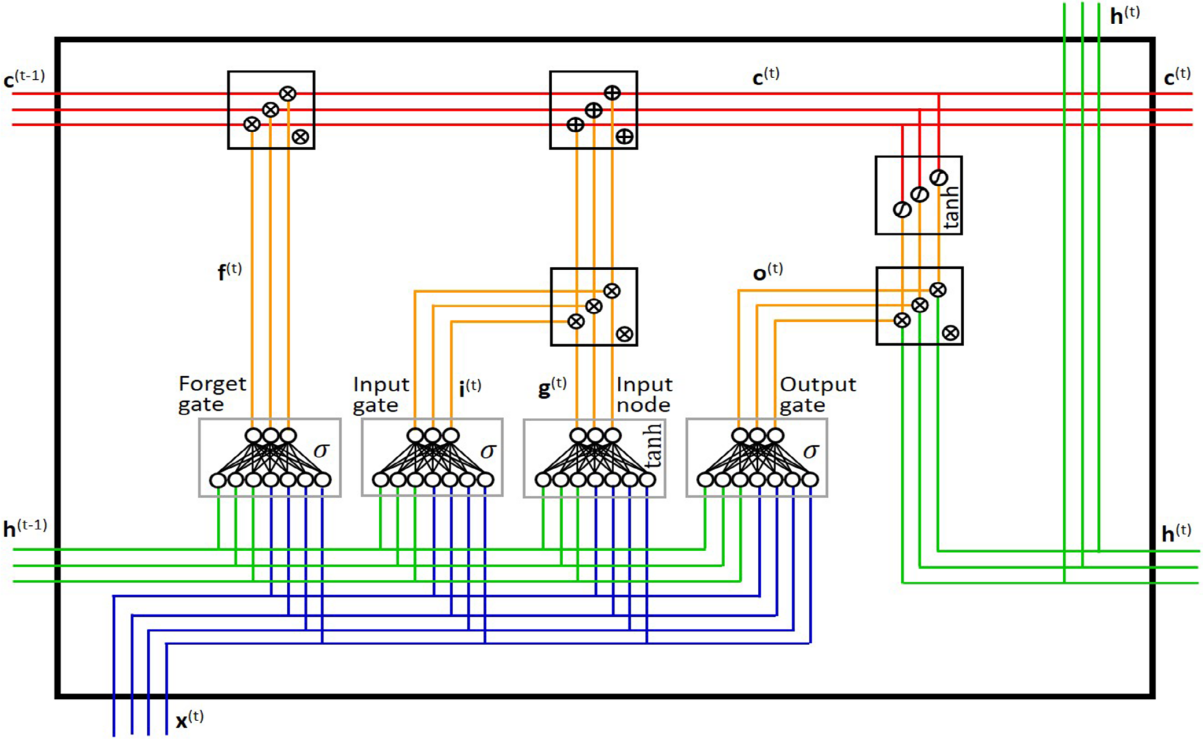

TY - JOUR AU - Chen, Yinlei AU - Xu, Jingyuan PY - 2026 DA - 2026/01/12 TI - Deep Learning for U.S. Bond Yield Forecasting: An Enhanced LSTM–LagLasso Framework JO - ICCK Transactions on Emerging Topics in Artificial Intelligence T2 - ICCK Transactions on Emerging Topics in Artificial Intelligence JF - ICCK Transactions on Emerging Topics in Artificial Intelligence VL - 3 IS - 2 SP - 61 EP - 75 DO - 10.62762/TETAI.2025.197745 UR - https://www.icck.org/article/abs/TETAI.2025.197745 KW - curve consistency projection KW - asymmetric economic calibration (AEC) KW - weakly-coupled second-maturity KW - yield curve forecasting KW - decision-aligned post-processing KW - basis-point economic loss KW - capacity-fair baselines AB - This paper advances a decision-aligned post-processing layer for government bond yield forecasts, turning competent sequence predictions into curve-consistent and economically calibrated outputs with minimal engineering burden. Starting from capacity-fair baselines in the LSTM, GRU and compact transformer families, used only to generate initial point forecasts for five, ten and thirty year maturities at short horizons, we add two model-agnostic stages. A curve consistency projection enforces monotone ordering across maturities and, when warranted, mild convexity while preserving local signal. An asymmetric economic calibration then learns a monotone mapping that down-weights the costlier side of error in basis points and in price space via duration and convexity. Rather than a perfectly linear workflow, we report practical adjustments such as solver choices for the projection and calibration folds for stability. Evaluation considers violation rates, smoothness and decision-weighted loss, and probes weakly coupled transfer from ten year forecasts to five and thirty year using rolling linear links without retraining. Results indicate lower violation rates and reduced economic loss to some extent across horizons, though gains can depend on regimes and may partly reflect calibration rather than new information. Alternative explanations including liquidity frictions or structural breaks remain plausible, and further research is needed on denser tenor grids, portfolio utilities and additional markets. SN - 3068-6652 PB - Institute of Central Computation and Knowledge LA - English ER -

@article{Chen2026Deep,

author = {Yinlei Chen and Jingyuan Xu},

title = {Deep Learning for U.S. Bond Yield Forecasting: An Enhanced LSTM–LagLasso Framework},

journal = {ICCK Transactions on Emerging Topics in Artificial Intelligence},

year = {2026},

volume = {3},

number = {2},

pages = {61-75},

doi = {10.62762/TETAI.2025.197745},

url = {https://www.icck.org/article/abs/TETAI.2025.197745},

abstract = {This paper advances a decision-aligned post-processing layer for government bond yield forecasts, turning competent sequence predictions into curve-consistent and economically calibrated outputs with minimal engineering burden. Starting from capacity-fair baselines in the LSTM, GRU and compact transformer families, used only to generate initial point forecasts for five, ten and thirty year maturities at short horizons, we add two model-agnostic stages. A curve consistency projection enforces monotone ordering across maturities and, when warranted, mild convexity while preserving local signal. An asymmetric economic calibration then learns a monotone mapping that down-weights the costlier side of error in basis points and in price space via duration and convexity. Rather than a perfectly linear workflow, we report practical adjustments such as solver choices for the projection and calibration folds for stability. Evaluation considers violation rates, smoothness and decision-weighted loss, and probes weakly coupled transfer from ten year forecasts to five and thirty year using rolling linear links without retraining. Results indicate lower violation rates and reduced economic loss to some extent across horizons, though gains can depend on regimes and may partly reflect calibration rather than new information. Alternative explanations including liquidity frictions or structural breaks remain plausible, and further research is needed on denser tenor grids, portfolio utilities and additional markets.},

keywords = {curve consistency projection, asymmetric economic calibration (AEC), weakly-coupled second-maturity, yield curve forecasting, decision-aligned post-processing, basis-point economic loss, capacity-fair baselines},

issn = {3068-6652},

publisher = {Institute of Central Computation and Knowledge}

}

Copyright © 2026 by the Author(s). Published by Institute of Central Computation and Knowledge. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made.

Copyright © 2026 by the Author(s). Published by Institute of Central Computation and Knowledge. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. ICCK Transactions on Emerging Topics in Artificial Intelligence

ISSN: 3068-6652 (Online)

Email: [email protected]

Portico

All published articles are preserved here permanently:

https://www.portico.org/publishers/icck/